Revealed: Undervalued Stocks To Buy In 2023

- Lewis Cowham

- Oct 6, 2022

- 3 min read

Updated: Oct 25, 2022

What makes a stock undervalued?

An undervalued stock is determined by it's potential growth in the future in a specific time frame (mostly long term) A growth of a stock and in this case, an undervalued stock, can be predicted using previous cash flow, bank statements and past growth.

But what exactly does undervalued mean? When a stock gets impacted by the economy, crashes or enters a recession, the stock will start to go down. If a popular and stable undervalued stock/company such as the Nasdaq or Apple is growing and expected to grow continuously but suddenly crashes due to a recession for example, the stock will be known as undervalued.

The top undervalued stocks to buy in 2023:

Alphabet GOOGL

Delta Air Lines

Lithium Americas LAC

ASML Holding

NIO

Amazon AMZN

Netflix NFLX

A great example is when many stocks crashed during the COVID 19 pandemic and later in the year, they were undervalued company's to invest in. However, technology businesses surged during the pandemic such as Shopify, Google and Yahoo.

In simpler terms, undervalued stocks are assets which should be at a higher price or has high growth potential compared to the stocks current stock price.

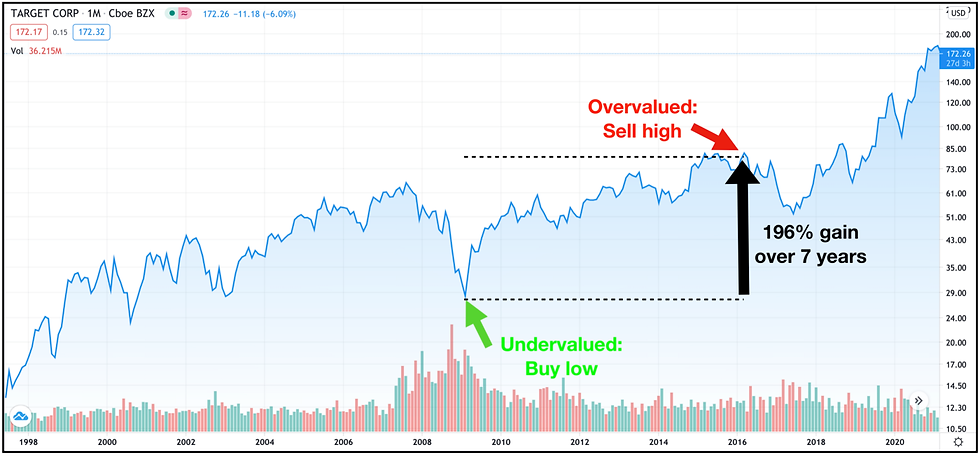

Above is an example of an "undervalued stock" where price is at a low (also known as a dip) Investors looking for a "dip" can result in a higher demand for the stock, hence why it bounces back.

How to find undervalued stocks and what to look for

If you are a long term investor and not trading for the short term, fundamental analysis (news) is the main place to identify undervalued stock market opportunities.

Fortunately in today's age, advanced technology can be used to our advantage to identify a good value for investment in the stock market.

These days, you don't need to worry about searching up news and trying to find an undervalued company. On most financial brokers, they will offer a service with a list of predicted range of value on whatever stock you are researching. Most brokers provide you with an "overview" tab of a stock such as Etoro and within that section, they will also provide you with a full report on the business revenue, price target, earning per quarter, average price etc.

You can also visit chart platforms like TradingView to use advanced chart indicators such as the relative strength index (RSI) or the moving average convergence/divergence (MACD) to determine if the value of the stock is under bought or over bought.

What industry will boom in 2023?

Travel The travel industry is expected to grow 15% from 2022 to 2026. As the pandemic was introduced worldwide, the travel industry took a hit and is expected to bounce back quicker than any other industry.

Healthcare This industry is predicted to grow with another double-digit percentage gain at the end of 2022. With more demand of vaccines and medicine, this can be an opportunity in the financial markets in 2023.

Technology Yes, technology businesses can take a hit regularly. Although, technology stocks are really safe to invest in, with almost every tech company consistently growing each year. The main advantage industry has compared to all the others, is it can surge through unexpected events such as pandemics or natural disasters.

In this chart above, it shows the growth Shopify gained through the COVID 19 pandemic. Due to everyone being forced to work from home or even having to quit their job, Shopify started to gain traction from everyone starting online ecommerce stores.

Try Shopify for free

Shopify's mission is to make commerce better for everyone by building the best experience for running a store, selling online, or accepting payments.

What sector is undervalued right now?

Investing is a complicated and often daunting task. With so many stocks to choose from, it’s hard to know which ones will give you the best return on your investment. But there are some sectors that are undervalued right now, meaning they have lower prices than their actual worth.

The three sectors that are undervalued right now are:

Pharmaceuticals

Biotechnology

Healthcare

Comments